Baltimore Sun

February 13, 2019

Pamela Wood

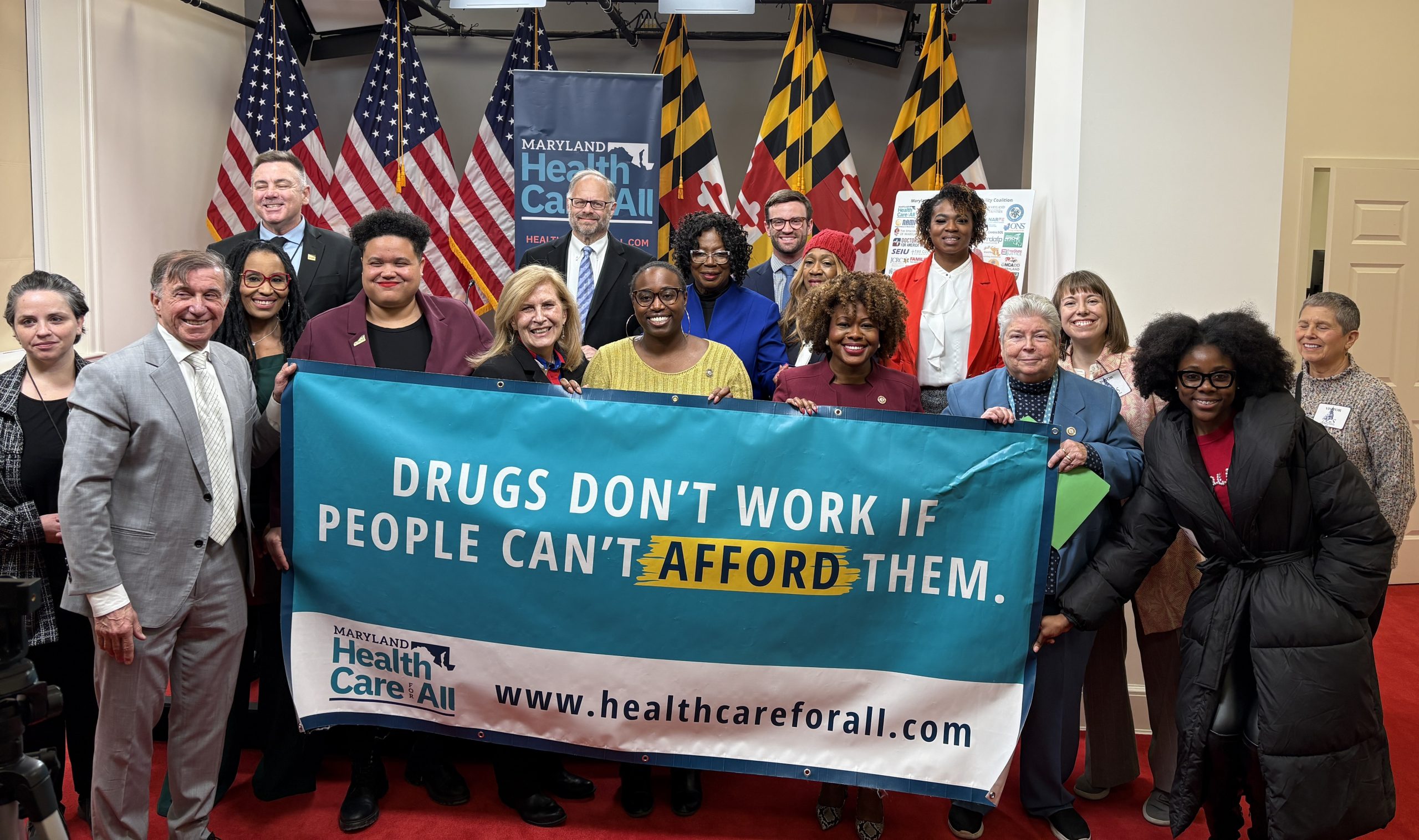

A coalition of state lawmakers and health organizations gathered in Annapolis Wednesday to rally support for a bill that would require Maryland residents to have health insurance or face a fine — money that could then be used to help them and others afford coverage on the state’s exchange.

The proposed legislation, which is supported by groups representing the state’s doctors and hospitals, is being considered by the General Assembly as the federal government has stopped enforcing the Affordable Care Act’s requirement to have insurance, known as the individual mandate.

Health advocates credit the individual mandate — which also had imposed a penalty on people who did not obtain insurance — with helping increase the number of Americans who are covered by health plans. They worry the loss of the mandate will reverse the progress.

“We don’t want to go backward,” said Sen. Brian Feldman, a Montgomery County Democrat who is a sponsor of the bill.

Before the Affordable Care Act, Maryland’s rate of uninsured residents was 12 percent, he said.

Now, he added, it’s 6 percent.

Feldman said the proposal is a “creative” approach to insuring more Maryland residents.

“We have to protect the ACA in Maryland. We have to protect ourselves against what the federal government is doing,” said Del. Joseline Pena-Melnyk, a Prince George’s County Democrat who is the bill’s lead sponsor in the House of Delegates.

Under the lawmakers’ proposal, Maryland residents would be required to answer a question on their state tax return asking whether they have health insurance.

A taxpayer who does not have insurance would be assessed a penalty, which starts at $700. The taxpayer can avoid paying that penalty by agreeing to use the money to sign up for insurance.

Those taxpayers would be forwarded to the state’s health insurance exchange, where individuals can buy plans.

Supporters said the tax return question could identify about 50,000 Maryland residents who qualify for Medicaid, the government insurance program for people with low incomes.

They also say another 70,000 state residents identified through the tax return question would be able to sign up for an insurance plan for less than the cost of the $700 penalty.

“The Affordable Care Act has been a tremendous success in Maryland. We have to protect that success and build on it,” said Vincent DeMarco, president of the Maryland Citizens’ Health Initiative, which is backing the bill.

He’s calling the bill the “health insurance down payment proposal.”

The bill has been endorsed by the Maryland Hospital Association, the American Heart Association and MedChi, the Maryland State Medical Society.

The idea for the bill comes from Families USA, a national nonprofit group that advocates for healthcare reform. No other state has adopted such a program, said Stan Dorn, a senior fellow at Families USA.

Dorn said Maryland could be “an exciting model” for other states.

Gov. Larry Hogan, a Republican, has previously said that the federal penalty for not having insurance was punitive, and that he favors incentives over penalties.

Feldman and Pena-Melnyk said they hope Hogan will work with lawmakers on this issue — as he did last year when the governor and General Assembly worked to stabilize insurance rates for people who buy their own insurance by charging a tax on insurance companies.

The bill would require significant changes at the Office of the Comptroller, which oversees state tax returns. A spokeswoman said Comptroller Peter Franchot is monitoring the bill but has not taken a position.

A Senate hearing is scheduled for March 6. No House of Delegates hearing has been scheduled.

Last modified: February 13, 2019