The Washington Post

Sunday, April 10, 12:08 AM

ANNAPOLIS, Md. — Maryland’s sales tax on alcohol would rise 50 percent in July, under legislation that advanced in the House of Delegates late Saturday night.

The House debated a major change to the bill for hours after the Ways and Means Committee voted to increase the tax from 6 percent to 9 percent at the start of the next fiscal year, instead of phasing it in over three years. The measure also was changed to allocate $47.5 million of the new revenue for school construction, steering a big portion of the money to large jurisdictions. A companion bill would increase money for the developmentally disabled from $5 million to $15 million.

Democratic supporters said Maryland schools and the developmentally disabled need the money. But Republicans criticized the measure for raising taxes that they say will hurt small businesses during tough economic times, while directing a lot of money to schools in urban and suburban areas.

Delegate Melvin Stukes, D-Baltimore, said many schools in Maryland’s largest city need the money badly, while some schools in other parts of the state are in far better condition.

“We’ve got 120 facilities that some of you heard me say, if I had my way, I would tear every single one of them down, because some of the facilities are in such bad condition that some of us wouldn’t allow our canines to go into, and that’s a fact,” Stukes said before the House Ways and Means Committee approved the bill.

Delegate Kathy Afzali, R-Frederick, said she constantly hears Maryland politicians talk about “one Maryland,” repeating a phrase often spoken by Democratic Gov. Martin O’Malley. But she said that concept wasn’t reflected in the legislation.

“On the one hand, I hear: ‘We are one Maryland. We have to look at this as a big picture,’” she said. “But then continually, in the last three months, I see that we’re not one Maryland. That it’s ours and yours.”

Maryland’s largest jurisdictions, Montgomery and Prince George’s counties and Baltimore city, would each receive $9 million. Anne Arundel County would get $5 million, and Howard County would receive $4 million. Baltimore County would get $7 million. Allegany, Carroll, Garrett, Frederick and Washington counties would receive $750,000. Calvert, Charles and St. Mary’s would receive $1.3 million. Eastern Shore counties — including Dorchester, Caroline, Kent, Queen Anne’s, Somerset and Talbot — would get $1.3 million.

The money would go to the schools in the first year of implementation.

In other action Saturday, the House also made changes to a similar alcohol tax bill that has already been approved by the state Senate. The House is working with both bills as it tries to increase money for school construction as well as for the developmentally disabled.

The amended Senate bill would direct another $12 million to Baltimore city and $9 million to Prince George’s County. It also would mean an additional $1.4 million that would be split by Allegany and Garrett counties.

The measures will have to pass both chambers on Monday, the last day of the session, to get to Gov. Martin O’Malley.

Major alcohol suppliers have strongly criticized the legislation. Three industry representatives — Peter Cressy, president of Distilled Spirits Council of the United States, Joseph McClain, president of the Beer Institute and Robert Kock, president of the Wine Institute — wrote in a letter to lawmakers that the tax increase would end up hurting the state.

“State revenue would further be diminished by lost sales from consumers in neighboring states,” they wrote. “Many of Maryland’s out-of-state customers will simply stay home to avoid the state’s new layer of taxation.”

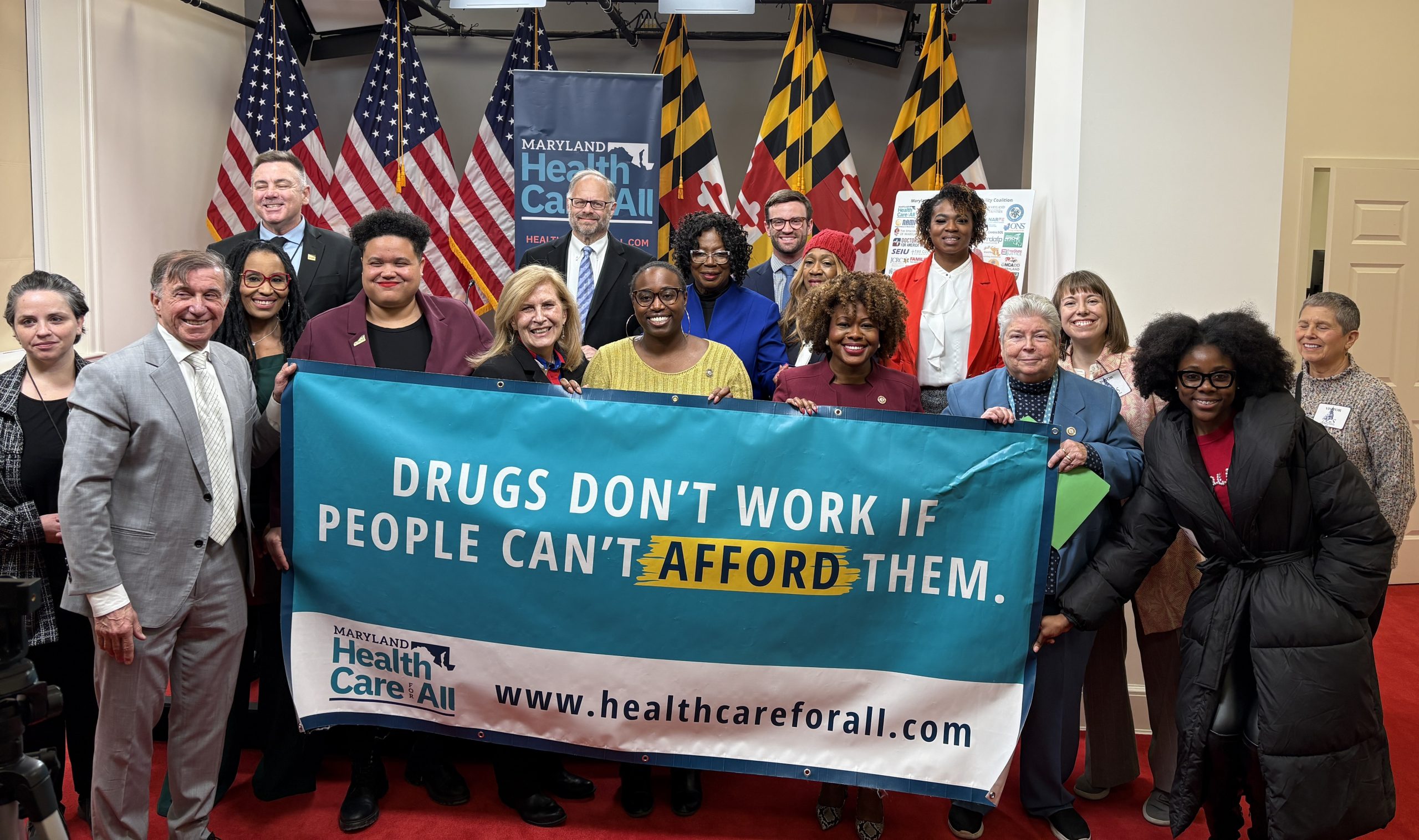

Vincent DeMarco, president of the Maryland Health Care for All Coalition, praised the changes in the legislation.

“We commend them for doing this, and we hope that the Senate will go along,” DeMarco said.

Last modified: April 11, 2011