County announces campaign to promote tax breaks to offset health insurance costs

Gazette.net

by SHERRY GREENFIELD, Staff Writer

Help is available for small businesses and nonprofit organizations in Frederick County struggling to pay health insurance for their employees.

Businesses and nonprofits with 25 or fewer employees, whose average salaries are less than $50,000 per year, can apply for a tax credit from the federal government of up to 35 percent to offset the cost of health insurance.

“Our job is to get the message out,” said Vincent DeMarco, president of the Maryland Citizens’ Health Initiative. “We don’t want to leave any of this federal money left on the table. We need to get the message out. Working together we can make sure every small business in Maryland is eligible and every small business in Frederick is eligible.”

DeMarco was part of a press conference today at Winchester Hall, the seat of Frederick County’s government, announcing a new campaign encouraging small businesses and nonprofits to apply for tax credits to offset the costs of providing health insurance.

The availability of the tax credits is a provision in President Obama’s Patient Protection Affordable Health Care Act, signed into law last year. Obama’s measure is intended to reduce health care costs and protect the consumer.

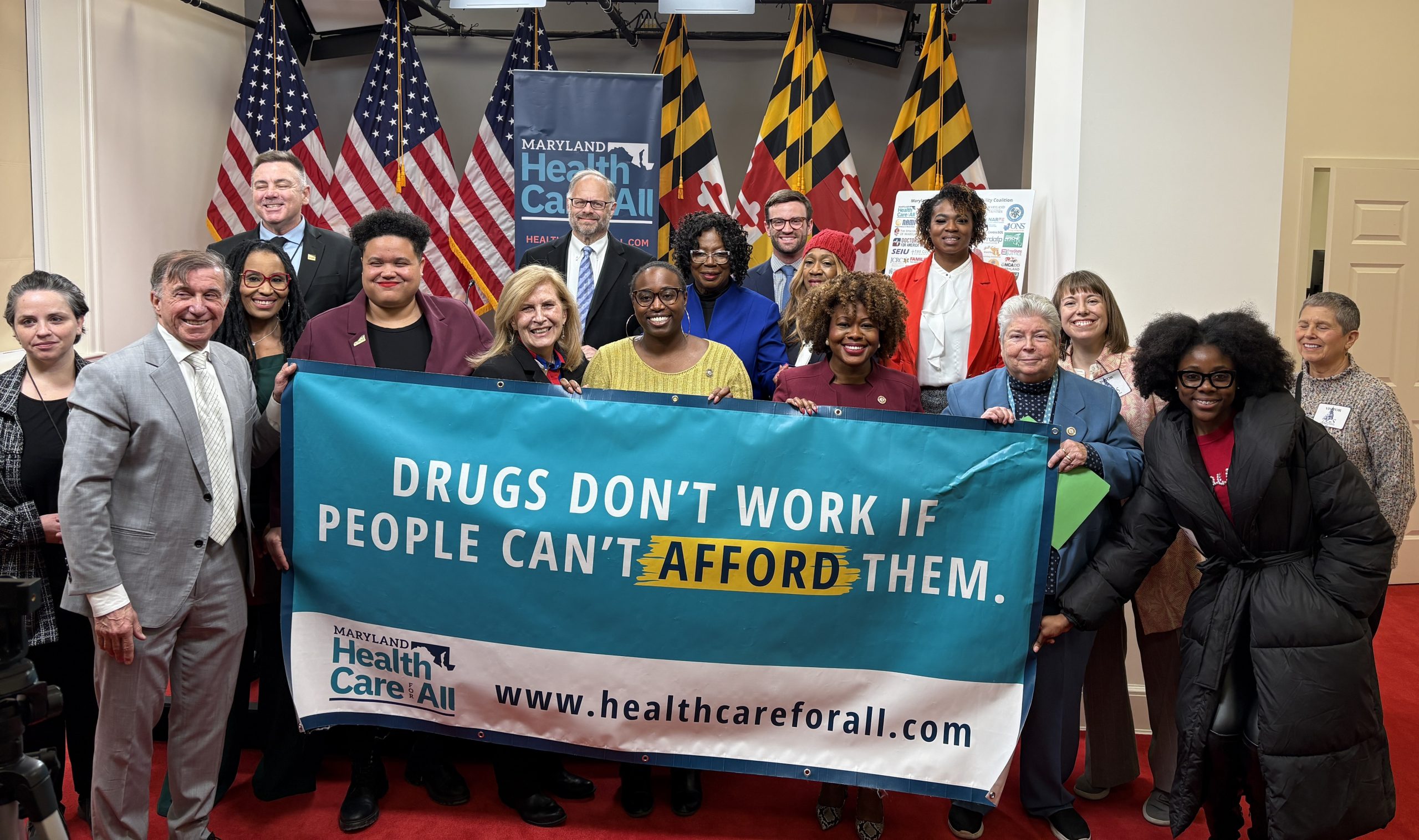

The Maryland Health Care for All! Coalition, which advocates health care issues on behalf of consumers, has initiated a campaign to let small businesses around the state know these tax credits are available.

The Frederick Board of County Commissioners and the Frederick County Health Department held a joint press conference today to announce the campaign.

“We want to do everything we can do to create a business-friendly atmosphere and we want to do everything we can to help small businesses,” said Commissioners’ President Blaine R. Young (R). “The majority of what makes this world go around is small businesses.”

DeMarco said he estimates there are 66,000 small businesses in the state that are eligible for the tax credits.

DeMarco said he did know how many small businesses or nonprofits in Frederick County would be eligible.

The Frederick County Office of Economic Development website states that there are 4,248 businesses in the county with zero to nine employees, and 1,211 businesses that have between 10 and 49 employees. It does not have a number for organizations that have fewer than 25 employees.

There are 1,510 tax exempt nonprofits in the county, according to Tax Exempt World, which provides tax information on nonprofit agencies.

To qualify for the credit, a business owner must also pay at least 50 percent of the premium cost of the employees’ health coverage. The amount of the federal tax credit is calculated on a sliding scale, with a maximum of 35 percent for businesses and 25 percent for nonprofits, which receive the credit on payroll taxes.

Health care advocates consider these tax credits an attempt by the federal government to help small businesses and nonprofits.

“The governor recognizes that small businesses are the engine of the economy,” said Carolyn Quattrocki, executive director of Gov. Martin O’Malley‘s (D) Office of Health Care Reform. “They are certainly the engine of the recovery. We all know that small businesses pay 18 percent more than large firms for their employees. We’re trying to get this message out and help make Maryland healthier.”

For information, go to www.smallbusinesstaxcredits.org.

Last modified: June 23, 2011