The Washington Post

April 11, 2011

ANNAPOLIS, Md. — A measure to raise the sales tax on alcohol from 6 percent to 9 percent in July will be among the most hotly debated bills before the Maryland General Assembly on Monday as lawmakers work toward midnight adjournment.

The 50 percent increase in the sales tax on alcohol would raise about $85 million a year. The House of Delegates changed the bill late Saturday night to start the full increase in July, instead of gradually implementing it over three years. A large portion of the money will go toward school construction in the first year. The amount allocated to help people with developmental disabilities would rise from $5 million to $15 million.

Public health advocates who pushed earlier in the session for an even bigger increase in the alcohol tax were in the capital early Monday to cheer the bill.

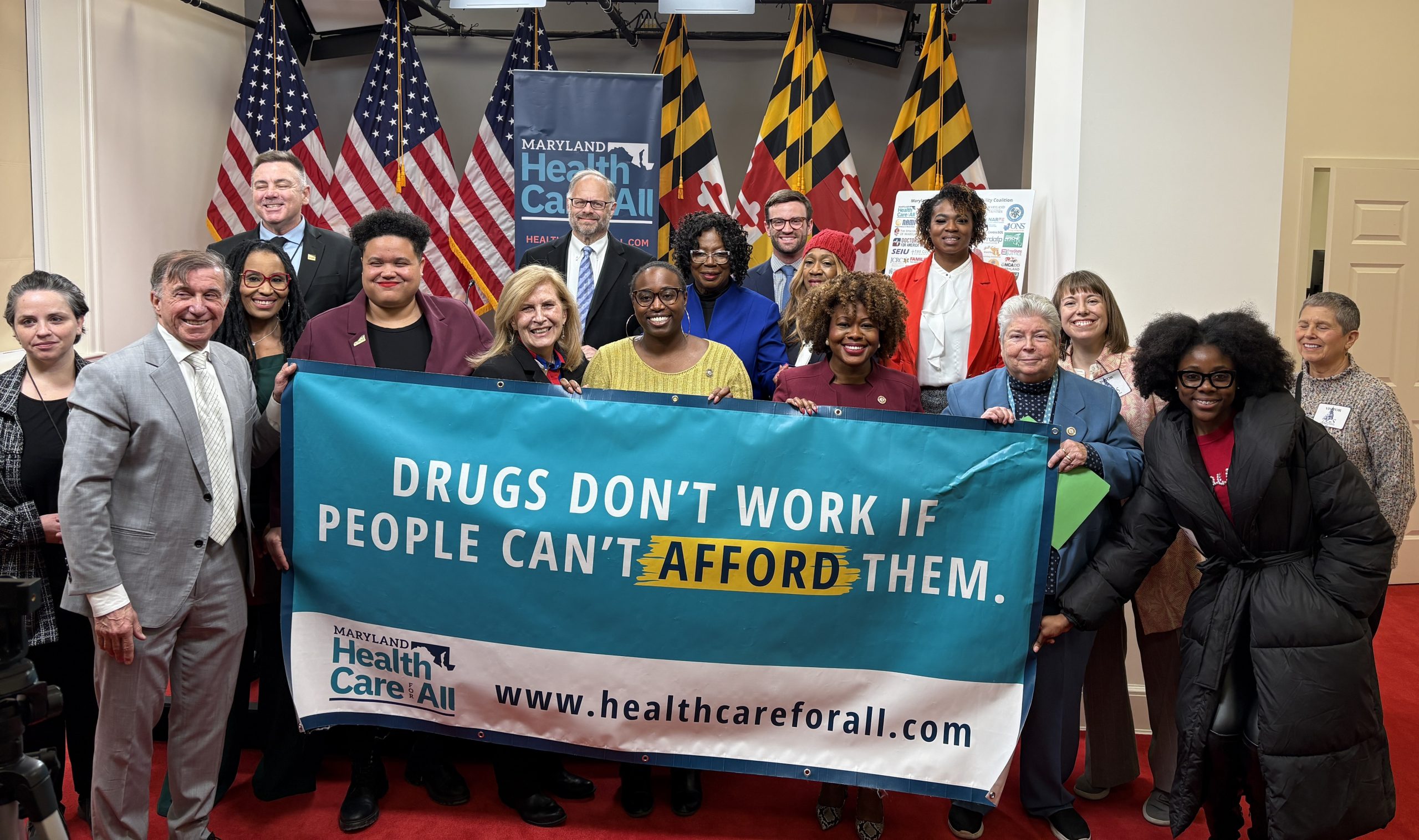

“We are hopeful, and what we’re hearing is that the Senate will approve what the House does,” said Vincent DeMarco, president of the Maryland Health Care For All Coalition.

The Democratic-controlled House rejected a barrage of amendments from Republicans in a late Saturday night debate. The GOP criticized the idea of raising a tax they say will hurt small businesses. Republican lawmakers also denounced provisions that would steer the bulk of the proceeds to urban and suburban schools. But Democrats countered that schools and the developmentally disabled have needed the money for years.

The House changed legislation to allocate $47.5 million of the new money to school construction. Montgomery and Prince George’s counties as well as Baltimore city would receive $9 million each. Baltimore County would get $7 million; Anne Arundel County would receive $5 million; and Howard County would get $4 million. Allegany, Carroll, Garrett, Frederick and Washington counties would get a total of $750,000. Calvert Charles and St. Mary’s would receive $1.3 million. Eastern Shore counties, including Dorchester, Caroline, Kent, Queen Anne’s, Somerset and Talbot, would get a total of $1.3 million.

The House also made changes to an alcohol tax bill already passed by the Senate. That bill has an additional $9 million for Prince George’s County schools and $12 million for Baltimore schools.

With the Preakness Stakes set for next month, Maryland lawmakers also will be grappling with legislation to allocate millions of dollars in state aid to help Maryland’s troubled horse racing industry. Under a bill moving through the Senate, Maryland race tracks would have to agree to simulcast their races before they get help.

Lawmakers also will be working on O’Malley’s proposed Invest Maryland venture capital fund. The House has reduced the governor’s original idea for the state to auction off $142 million in tax credits to $100 million. The state would use the proceeds from the auction — up to $75 million — to invest in high-tech businesses.

While there’s plenty of fine-tuning to do, some key pieces of legislation this session have already been largely decided.

Lawmakers already have agreed to state pension reform. The amount state employees pay for retirement will rise from 5 percent to 7 percent, starting on July 1. Monthly premiums for health insurance will rise from 20 percent to 25 percent, and a co-pay system will be maintained. The plan, which was proposed by O’Malley, aims to increase Maryland’s funding of its pension system from 64 percent to 80 percent by 2023.

Pension reforms also include a “Rule of 90” to receive the normal retirement benefit. That means if an employee retires before the age of 65 with at least 10 years of service, the employee’s age and years of service must add up to 90. State employees hired after July 1 will be vested in the retirement plan after 10 years, instead of five years.

Some high-profile legislation backed by O’Malley already has been shelved for summer study. Lawmakers had too many questions about a proposal to require state utilities to enter into long-term contracts to buy wind energy from a wind farm planned for 12 miles off the coast of Ocean City. Lawmakers also decided earlier in the session to delay a proposal embraced by O’Malley in his February State of the State speech to crack down on septic system pollution.

Last modified: April 11, 2011