Frederick News Post

April 12, 2011

By Meg Tully

ANNAPOLIS — The Maryland General Assembly passed two controversial proposals — one to raise the sales tax on alcohol and the other to provide in-state tuition rates to illegal immigrants — with only hours left before adjournment when the clock struck midnight Monday night.Both proposals were overwhelmingly opposed in Frederick County’s delegation of state lawmakers, where all eight members opposed the alcohol tax and only Sen. Ron Young, a Frederick Democrat, supported the tuition bill.

Young voted differently on two bills dealing with the alcohol tax, but said Monday night that his vote for one of the bills was a mistake. He opposes the alcohol tax increase, he said, and was planning to ask Senate clerks to change his vote so both votes reflected his opposition.

The tuition bill — which allows illegal immigrants who have attended at least three years of high school in Maryland to get in-state tuition at the state’s community colleges and at four-year institutions if they continued their studies — was approved just after 9 p.m. by the House of Delegates in a vote of 74-65.

Its passage came despite a last-minute attempt earlier in the day to kill the bill by Sen. David Brinkley, a Frederick County Republican.

He was so opposed to the illegal immigrant tuition bill, he began a filibuster by reading from a book titled, “Born to Run,” by Christopher McDougall.

He got five pages into it before the Senate — lacking the 29 votes to defeat the filibuster — decided to tell the House of Delegates that the Senate would not accept House amendments to the bill. That vote forced the House to take another vote later in the evening accepting the bill as the Senate had originally passed it.

Brinkley, who had never read the book, said he had been prepared to read more than 300 pages of it for hours on Monday.

“This concept of giving illegal immigrants a discount to community colleges and university, I think, is just absurd,” Brinkley said. “It’s a poor policy decision, it costs more money, and we’re in tight straits as it is.”

The General Assembly wrapped up its 428th legislative session having killed proposals for gay marriage, offshore wind and a ban on new septic systems. They decided to move forward on providing financial incentives to waste-to-energy trash incineration plants, medical marijuana and criminalizing child neglect.

One of the last major proposals approved was the alcohol tax, where the state will start levying an additional 3 percent on sales of alcohol, bringing the total sales tax on it to 9 percent.

The Senate approved the last bill needed for that tax to become law just after 10:30 p.m. on Monday. That bill, which established the tax and sent some money to school construction, passed 26-19 in the Senate.

Another, complementary bill, which distributed another portion of the money to the developmentally disabled, passed the Senate 27-18. The vote would be 26-19 if Young is able to switch his vote to opposition.

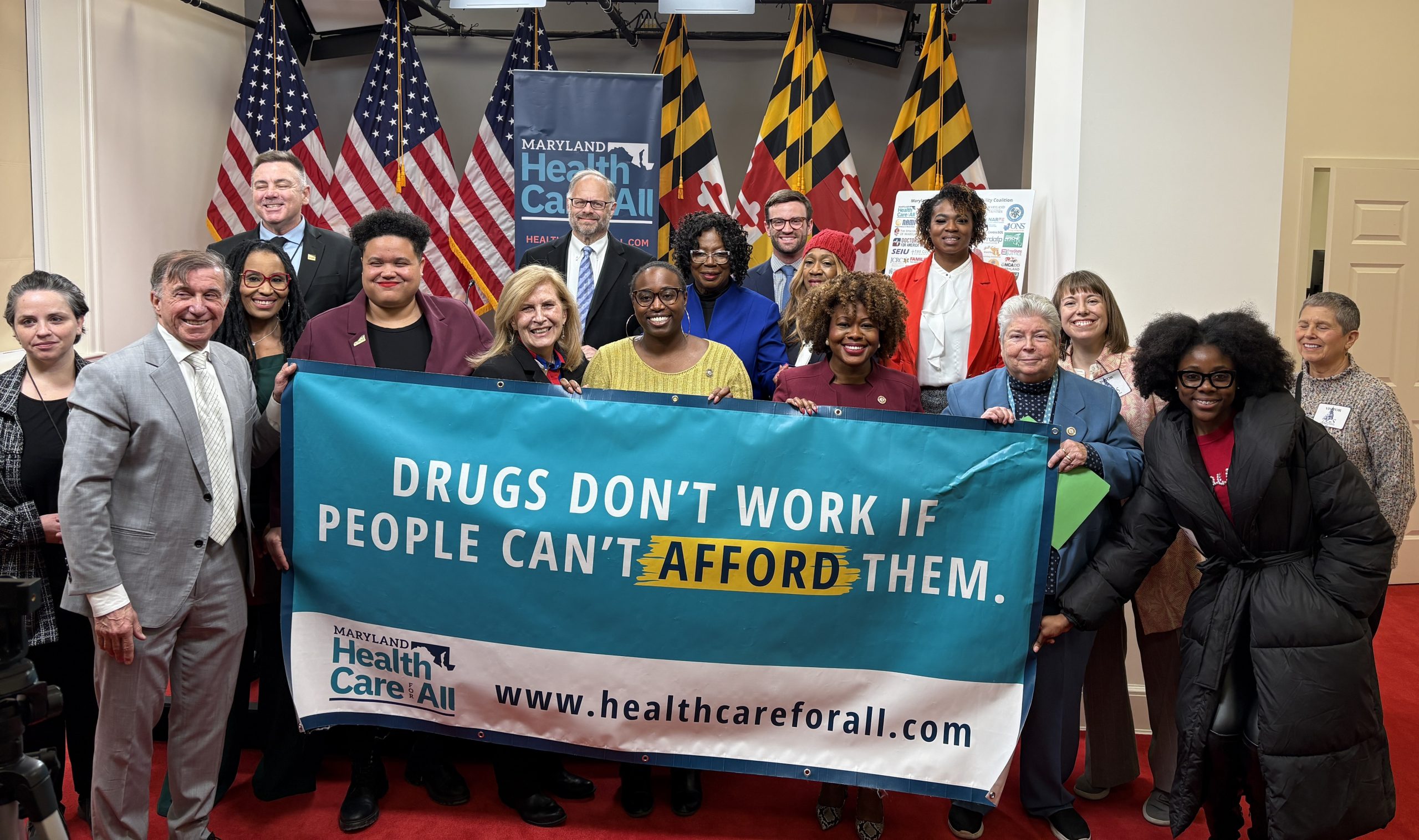

“We join national public health leaders in thanking the Maryland General Assembly for taking this courageous action to reduce underage drinking and alcohol abuse in our state,” said Vincent DeMarco, president of the Maryland Health Care for All coalition that advocated for the tax increase.

Maryland Gov. Martin O’Malley, a Democrat, said Monday afternoon he would sign the bill, which is expected to generate $85 million per year. About $15 million of that is slated to go to those with developmental disabilities.

O’Malley said he submitted a budget balanced with cuts, but the General Assembly decided the cuts would hurt the state too much.

“It was their considered judgment that after 50 years of that particular revenue not being increased, it was better to increase that revenue rather than allow that safety net to be eroded or underfunding of education,” O’Malley said.

Local businessman Gary Brooks, operations manager of Barley & Hops, opposed the tax increase throughout session and said Monday night he was disappointed in the “backroom shenanigans” it took to get the bill passed.

He objected to provisions of the legislation that gives money for school construction in the first year of the tax — of which, only a very small portion will come to Frederick County.

“It will make us noncompetitive, especially in the western part of the state, and the western part of the state is going to get the lowest amount of money,” Brooks said.

Western Maryland, which includes Allegany, Carroll, Garrett, Frederick, and Washington counties, stands to gain the least amount of school construction funding from the bill. They are getting $750,000 to split among the five counties.

Other areas of the state are getting the following appropriations: Baltimore city, $9 million; Prince George’s County, $9 million; Montgomery County, $9 million; Howard County, $4 million; Baltimore County, $7 million, the Eastern Shore, consisting of Caroline, Dorchester, Kent, Queen Anne’s, Somerset, Talbot, Wicomico, and Worcester counties, $1.25 million; Cecil and Harford counties $1.25 million; and southern Maryland, consisting of Calvert, Charles, and St. Mary’s counties, $1.25 million.

There are also additional school construction funding available to Allegany, Garrett, Baltimore City and Prince George’s counties under a separate appropriation that originated in the Senate.

Delegate Michael Hough, a Frederick County Republican, dedicated his no vote to Jerry’s and Hillside liquor stores of Brunswick and Kerrigan’s liquor store of Point of Rocks. He said they would be hurt the most by the tax increase because they are close to Virginia and West Virginia.

“When I go back to my county, I can’t say I brought you a lot of money, but I can say I voted for what’s right,” Hough said.

The bills passed the House with votes of 77-62 and 78-62, with all six delegates voting against.

Medical marijuana policy was also up for a final vote on Monday, passing the Senate. It was sponsored by Brinkley, along with Sen. Jamie Raskin, a Democrat from Montgomery County.

The bill will allow a “not guilty” finding for those charged with possession of marijuana if they are using it for medical purposes.

It also sets up a study of a more comprehensive medical marijuana program, where doctors would be prescribing the drug.

Brinkley called the bill’s passage “compassionate” in a press release.

“With the passage of this bill, the General Assembly has let seriously ill patients know they are not criminals for seeking relief from their pain and suffering,” he stated.

With Monday’s adjournment, state lawmakers will end their annual session and O’Malley is scheduled to begin bill signings today. A special session is expected to be called in the fall to address redistricting issues.

O’Malley said Monday that he’s concentrating on finishing up this session, and isn’t speculating about what other issues might come up during that session.

Last modified: April 12, 2011